Whether you’re self-employed, an independent contractor or a freelancer – Xero TaxTouch is made for you. Discover how a simple swipe delivers a fast, easy and completely mobile solution that organizes and manages your professional expenses and helps simplify your business related tax filings*.

Enjoy the benefits - Just reach for your iPhone to intuitively:

Stay organized, save time and forget about tax worries

· Untangle business and personal expenses from all your accounts – in one swipe

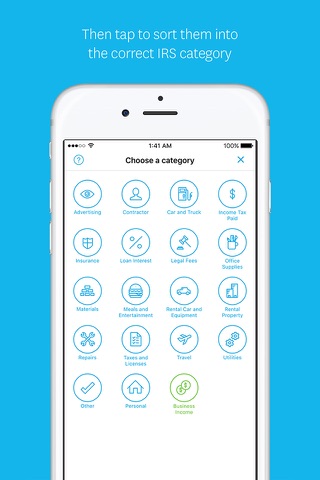

· Categorize business expenses into the right tax categories

· Attach photos of your receipts and add a note to your transactions

· Import bank and credit card transactions – every day – to prepare your Schedule C form, which helps with your tax filing

Enjoy a surprise-free tax time

· Generate a convenient year-end report (PDF or CSV)

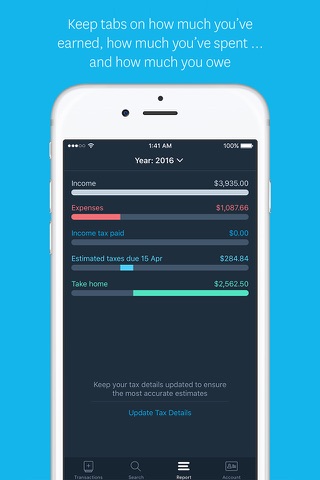

· See the estimated amounts you owe with estimated taxes

Get the money you deserve back in your pocket

· Simplify your tax filing with accurately categorized business expenses

· Get clear visibility into your business performance with simple, monthly “how I am doing?” reports

· Forget about omitting eligible business expenses

Thank yourself

All those swipes add up to a stress-free experience come tax time. Xero TaxTouch produces a year-end report (PDF or CSV) to:

· Make it easier for you to have the information you need at your fingertips to maximize deductions and make life easier when you file your Schedule C

· See the estimated amounts you owe with estimated taxes with “how am I doing?” reports

· Thank yourself with all the money you save

Relieve the tax anxiety with our free trial

Get started today with a three-month free trial and low post-trial subscription fees.

Low-cost subscriptions. Simply purchase a subscription within the app, for $5.99 per month or $29.99 for the first year.

Free trial. No commitment required to enjoy a three-month free trial and low post-trial subscription fees. Any unused portion of a free trial period, if offered, will be forfeited when the user purchases a paid subscription to Xero TaxTouch.

Auto-renewal and cancellation. Monthly subscription automatically renew until cancelled on a monthly basis unless auto-renew is turned off at least 24 hours before the end of the current billing period. Account will be charged for renewal within 24 hours prior to the end of the current period at the then current monthly fee for service. Subscriptions may be managed by the user and auto-renewal may be turned off by going to the users Account Settings after purchase. Annual subscriptions do not automatically renew unless explicitly stated otherwise. No cancellation of the current subscription is allowed during active subscription period/no partial refunds for then current billing period.

Customer support. If you lose your device, forget your password or have questions, contact [email protected] immediately for assistance.

Subject to change. Xero reserves the right to change pricing, terms, features and support at any time.

Need help? Visit https://xerotaxtouchhelp.zendesk.com

Have feedback or ideas? Please share them at [email protected]

Use of Xero TaxTouch subject to the Xero TaxTouch Terms of Use and Privacy Policy: https://www.xero.com/us/about/terms/taxtouch/ Please carefully review them and do not download Xero TaxTouch if you do not agree to them.

*Xero TaxTouch helps you organize your business expenses which can help you to save time and money when you prepare your Schedule C and maximize your business tax deductions.

*Xero TaxTouch is not a consumer product and should not be used to organize your personal expenses.

*Xero TaxTouch does not actually prepare or file tax returns or provide tax advice. Xero TaxTouch is provided as-is and all warranties (whether express or implied) are expressly disclaimed.